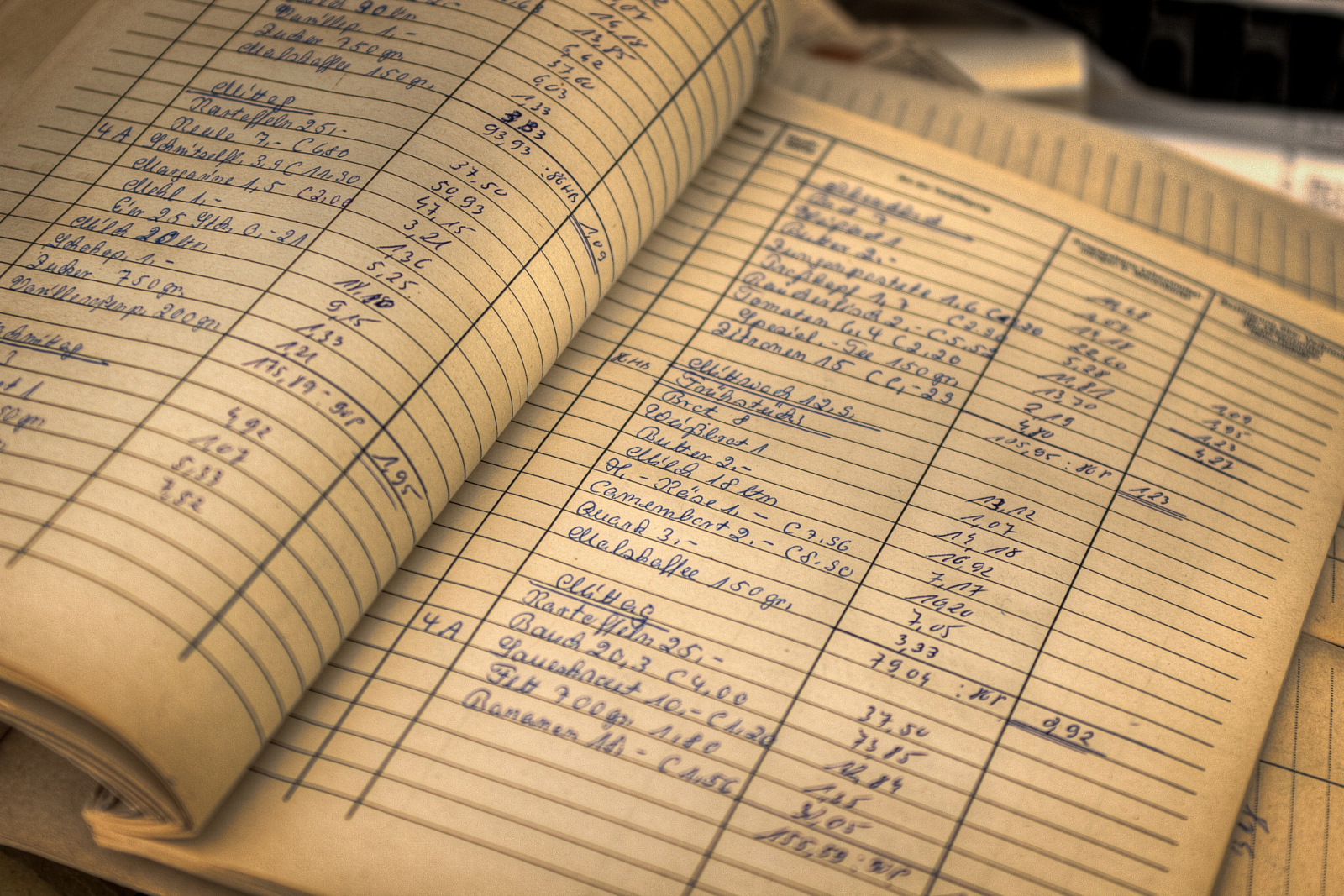

Bookkeeping for photographers doesn’t have to be challenging. Have you ever met a photographer that enjoys bookkeeping? I haven’t, and I certainly don’t enjoy it myself. It’s a necessary evil when running a business, and although you probably won’t ever come to love it, there are some simple changes you can make to help soothe your accounting headache.

I’m lucky enough to work with some really talented bookkeepers and there are some things I’ve picked up on along the way that have helped me with my own freelance bookkeeping.

DO back up your receipts

If you’re one of the lucky few who gets audited by your local tax authority they’ll want you to prove every expense you claimed was legitimately for business, and that means finding receipts.

Paper receipts are horrible things – always getting lost, crumpled beyond recognition and fading to uselessness. Many smartphone apps (check out Google Drive or Dropbox) will do a great job of turning photos into PDFs – spend a few minutes uploading copies of your receipts to your online storage of choice, and you’ll be a-OK if the tax man comes calling.

DON’T leave everything until the last minute

It’s the booking keeping for photographers classic tax screw-up – you put it off once, twice, three times, and, before you know it, the deadline is tomorrow and you haven’t even started your return. It’s perhaps the easiest tax pitfall to avoid but still every year hundreds of thousands of late returns are filed, meaning millions of dollars in late fines and extra tax owed, and plenty of frustrated freelancers.

If your bookkeeping takes twelve hours on the day before the deadline, that means a year’s worth of accounts takes about 15 minutes a week – wouldn’t it be easier for us to just set aside 15 minutes every week to keep your books up to date?

DON’T mix business with pleasure

If you’re operating your business finances out of a personal bank account you’re doing it wrong. Open another account and use it solely for business transactions. Opening a bank account is more complicated and annoying than it should be, but you’ll thank me in the long run.

When it comes to doing your bookkeeping you’ll save yourself hours if your business transactions are separate from personal spending. No filtering, no confusion – spend a little time up front getting set up properly and you’ll save yourself hours further down the line.

DO automate as much as you can

If you’re selling lots of low-value items (prints of your photos through an online store, for example) you’ll lose the will to live recording each transaction individually. Either sell through a marketplace like Etsy, or use a payment processor like Stripe to automate the process.

Most eCommerce systems will plug into your bookkeeping software of choice, or at the very least offer a spreadsheet export of your data. If you sell 2,000 prints over the course of a year a payment processing system could be the difference between ten minutes of bookkeeping and ten hours.

DO ask for advice if you’re stuck

Taxes are complicated and many people pay an accountant so they don’t have to think about them. If you’re a DIY bookkeeper you probably have more tax knowledge than other business owners, but nobody is expecting you to know everything.

When it comes to accounting, mistakes can be complex to rectify. If there’s something you just can’t figure out, ask around. There’s bound to be another freelancer who’s solved the same problem before.

If you’re really struggling for an answer, it’s well worth paying an accountant for an hour or two of advice. The upfront cost might sting, but it won’t hurt nearly as much as a penalty for filing an incorrect return.

Author Bio: Gavin Alexander knows freelance photography from both sides of the bookkeeping coin. He is a freelance videographer and photographer, as well as being Video Content Exec at Crunch Accounting. You can follow them on Twitter.

Leave a reply